EMV Chip Card

What is an EMV Chip Card?

An EMV chip is a small, metallic square that replaces the traditional magnetic strip cards. The EMV chip provides a unique transaction code unlike the traditional cards that can be replicated for counterfeit transactions. EMV chips will not prevent all forms of security breaches, but will decrease the amount of fraudulent activity from stolen debit card data.

All Members Exchange credit cards currently come with chip technology. If you have a Members Exchange debit card that does not contain the EMV chip, once your current card expires, the new card you will receive will contain the chip.

How to Use Your EMV Chip Card

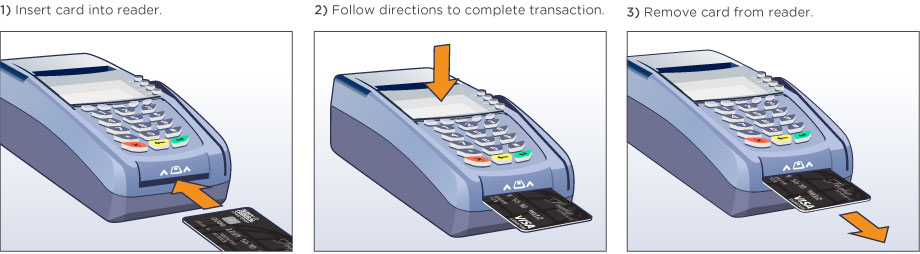

EMV chip cards will now be inserted into the payment device, instead of swiping the card to read the magnetic strip on the back (see below).

- Insert card into reader.

- Follow directions to complete transaction.

- Remove card from reader.

EMV Chip Card Frequently Asked Questions

What is an EMV chip?

A microprocessor chip embedded in your card that securely stores and transfers data. EMV stands for Europay, MasterCard® and Visa® after a joint effort between the three to ensure a secure and global way for MasterCard and Visa to be accepted worldwide. All Members Exchange credit cards have EMV chips embedded in them. We are in the process of converting debit cards to the EMV chip. When your current debit card expires, the new card you will receive will contain the EMV chip.

How can I get a debit or credit card with an EMV chip?

All Members Exchange credit cards currently come with chip technology. If you have a Members Exchange debit card that does not contain the EMV chip, once your current card expires, the new card you will receive will contain the chip.

What information is contained in a chip–enabled card?

The chip contains information required to authenticate, authorize and process transactions. This is the same type of information already stored in the magnetic stripes, but the chip uses a much more secure platform. No personal information about your account is stored on the chip.

What is the benefit of a chip–enabled card?

Security. It’s nearly impossible for thieves to create counterfeit EMV chip cards. That’s because these chips encrypt data differently for each transaction (dynamic authentication). Magnetic stripes provide the same data (static data) each and every time you conduct a transaction. Fraudsters have access to inexpensive means of making counterfeit versions of magnetic-stripe– only cards. In addition, chip–enabled credit cards are a standard transaction method around the world, so having this feature makes transacting abroad much easier.

Where can I use my chip–enabled card?

Your card will work anywhere Visa ® is accepted. Because some merchants will be slower to accept chip technology, your card still includes a magnetic stripe for use in traditional terminals.

With a chip–enabled card, do I still need to notify Members Exchange before I travel away from home?

Yes. To help ensure that legitimate purchases are quickly approved, please give us advance notification before you travel out of state.

Does a card with chip technology have additional fees?

No. There are no additional fees associated with your Members Exchange credit or debit card with chip technology.

Why does my chip–enabled card still have a magnetic stripe?

Some merchants will be slower to accept chip technology, so cards with EMV chips will still include a magnetic stripe for use in traditional terminals.

How do I use my chip-enabled card at checkout?

Merchants who accept cards with chip technology provide terminals for chip–enabled cards. If you swipe your card at an active terminal with the magnetic stripe, it will prompt you to insert your card. To conduct a transaction, just follow these easy steps:

- Rather than swiping your card, insert it into the terminal, chip first, face up and leave the card in the terminal while your transaction is being processed.

- Follow the prompts on the screen and sign the receipt or enter a PIN.

- When the transaction is complete, the terminal screen will prompt you to remove your card. Remember to take your card with you.

Will I be required to use my PIN?

Your card will continue to work for both PIN and Signature transactions just as it has in the past. However, depending on the merchant, you may find you are prompted to use your PIN more often than in the past when purchasing with your card.

Why aren’t more merchants ready to process debit chip transactions?

Debit cards are subject to additional regulations that impact how they’re processed. As a result, it’s taking time for merchants to introduce new chip-enabled terminals and software changes.

Some merchants have not converted to EMV card readers, so first implementation of EMV cards will have both an EMV chip and a magnetic strip. If a merchant has the ability to accept chip enabled cards, they are required to process the transaction that way. There are deadlines in which all merchants have to accept chip-enabled cards.

If you have questions about EMV Chip Cards, please contact Members Exchange.